Brexit - opportunity for entrepreneurs

The UK was one of the main target markets for Polish companies until recently. After January 1, 2021, a lot has changed and, by the UK’s exit from the European Union, a large number of entrepreneurs have left this market, fearing complicated formalities and, among other things, an increase in transport costs or a decrease in profitability.

Logistics

We will make sure that your goods arrive safely and on time at your destination.

Communication

Our professionals are fluent in English.

Network activities

Issue quotations and resolve technical problems.

Marketing

Obsługa marketplace, rozstrzyganie sporów i kontakt z klientem.

Logistics

We will make sure that your goods arrive safely and on time at your destination.

Network activities

Issue quotations and resolve technical problems.

Communication

Our professionals are fluent in English.

Marketing

Marketplace support, dispute resolution and customer contact.

Exit of the United Kingdom from the European Union

The UK left the EU on February 1, 2020. To secure the interests of both parties to the withdrawal agreement, a transition period was introduced, which lasted until December 31, 2020. On January 1, 2021, the current trading of goods on an intra-Community basis stopped. Now, all transactions from EU countries with UK entities, including mail-order sales, are treated as transactions with third-country entities. So it will no longer be intra-Community supply of goods, but imports and exports.

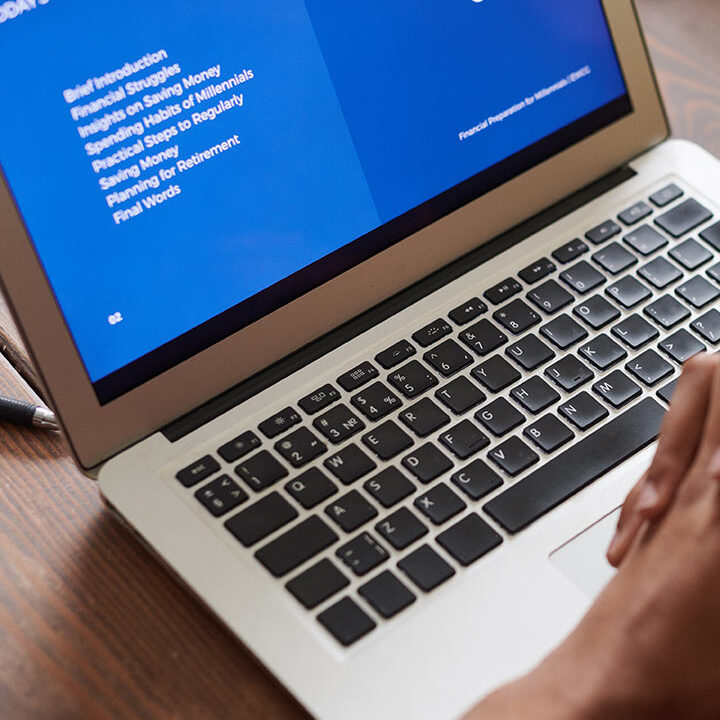

Everything that you need to know about sales in the UK after Brexit

To contact E-prom is the first step to successful distribution in the UK. When the Polish zloty weakens you earn in pounds!

Need to enter a new area such as export of goods does not have to be an impulse to abandon the English market. For many companies, it may be just the incentive, to open up to new, unfamiliar territory or return to the UK market, with the right support from our company. No matter if you are held back from the next step in your company's development by a language barrier, lack of experience or a growing volume of documentation. We are able to help you. Successful and profitable sales to the UK, can be conducted through your online store or through platforms such as Ebay or Amazon. Each of these solutions opens up a new market and gives you access to new customers.

Many changes regarding Vat, customs and excise duties took place after England left the European Union. Existing supply chains have changed, and these changes have meant that the operations of many companies have had to adjust to the new conditions. With the right support, these changes need not be painful and complicated. The experience, knowledge and skills possessed by our employees will help your company find its way in the new market that the UK has become.

The change in the qualification of the supply of goods to the UK has triggered a number of modifications in the process of calculating Vat. From January 1, 2021, taxpayers can use the zero vat rate in this regard, the condition is to collect the relevant documents confirming the export of goods to a third country.

The application of the zero vat rate will be possible after obtaining customs documents confirming the export of goods outside the EU (it must be obtained before the deadline for filing the return for a given period). The Vat Law specifies what conditions of supply, export by certain entities in the supply chain, must be met and documented in order to apply the zero rate for export. If, on the other hand, the transaction is an export within the meaning of VAT, but the conditions for applying the zero percent rate are not met, the taxpayer will have to pay VAT as for a national supply.

Vat exemption in Poland can take place when certain conditions are met for the export of goods to third countries. At the same time, however, there is a need to settle Vat on imports in the UK.

The following change relates to the moment of determining tax liability. In the intra-Community supply of goods, the tax obligation arises when the taxpayer issues an invoice, but no later than the 15th day of the month following the month in which the supply was made. In the case of export, on the other hand, the tax obligation comes into existence at the time the goods are delivered from Poland.

The new rules of conduct cover the supply of goods made either directly from an online store or through sales platforms like Amazon or Ebay. The only difference is that in the former case VAT is calculated and paid to the UK tax authority by the Polish trader, and in the latter case by the relevant sales platform on his behalf.

Additional steps and rather complicated regulations make trading with the UK may seem complicated and full of pitfalls at first glance. However, it should be remembered that the main factor in deciding whether to enter or leave a given market is the profitability of a given business. Given the right facilities and the introduction of favorable solutions, offering British consumers goods from Polish territory can become profitable.

In transactions made through e-commerce platforms with non-businesses in England, the value of the order will play a key role. For sales of up to £135 worth of goods, the obligation to pay vat, at UK rates, lies with the relevant platform. It appears on the side of the seller if he makes sales through his own online store. Above the amount of £135, the delivery will be settled on the same basis as for export to another third country.

The amount of 135 pounds should be interpreted as the price due to the customer, in the case of several items for one recipient, the value of the entire order counts. This amount does not include transportation costs and other additional charges. Regardless of whether sales in GB will be made through an online store or a selected sales platform, the seller is required to register as a VAT payer in the UK.

Each transaction of sale and shipment of goods from Poland to the UK must be confirmed with an export document by Customs. How the export is declared depends on the chosen shipping company and the type of shipment. Some courier companies require full documentation for each shipment, and some of them complete such documentation for us on the basis of the declared data. The additional steps involved in shipping goods increase delivery time and complicate the entire process. It is also important that the goods being shipped and being sent to the UK are on the list of products allowed for export.

The £135 amount should be interpreted as the price due to the customer, in the case of several items for one recipient, the value of the entire order counts. This amount does not count shipping costs and other additional charges. No matter whether sales in GB will be made through an online store or a selected sales platform, the seller is required to register as a VAT payer in the UK.

Exporting goods outside the European Union requires an EORI number. This is the number by which a given company is identified in the system for handling customs declarations. The EORI identification number is based on a VAT number, and in order for it to be active it is necessary to apply to the appropriate customs authority. It is necessary for the carrier lun the customs office if you want to export goods from the European Union to third countries.

The amount of £135 should be interpreted as the price due to the customer, in the case of several items for one recipient, the value of the entire order counts. This amount does not include transportation costs and other additional charges. Regardless of whether sales in GB will be made through an online store or a selected sales platform, the seller is required to register as a VAT payer in the UK.

When exporting goods to the UK, it is necessary to know the unified tariff codes. The British codes used for customs clearance allow statistical qualification of products.

The next obligation imposed on the exporter is to confirm the origin of the goods. This involves indicating the situation when the trader trades in goods produced, for example, outside the EU. These products may be subject to, for example, anti-dumping duties and be subject to completely different settlements. A statement of origin is therefore necessary.

The amount of £135 should be interpreted as the price due to the customer, in the case of several items for one recipient, the value of the entire order counts. This amount does not include transportation costs and other additional charges. No matter whether the sale in GB will take place through an online store or a selected sales platform, the seller is required to register as a VAT payer in the UK.

When selling your goods to third countries including the UK, do not forget that consumer rights apply to buyers from both EU and non-EU countries. As far as consumer rights are concerned, regulations in Poland can be applied. Provided that in the buyer's country the regulations are not more favorable to him. Then the regulations more favorable to the consumer must be complied with.

What can we provide you?

Customer contact

Handling orders, complaints. Contact and intervention with sales platforms in case of any problems.

Translation of the auction

We have international sales specialists with marketing expertise. We know how to make online sales.

Handling auctions and announcements

We will sell your goods on foreign portals. We will also create a foreign store for you that will make money online.

Handling auctions and announcements

We will sell your goods on foreign portals. We can also create a foreign online store for you.

Customer contact

Handling orders, complaints. Contact and intervention with sales platforms in case of any problems.

Translation of the auction

We have foreign sales specialists with marketing expertise. We know how to make online sales.

See our projects

We are recommended by

Domki nad Potokiem

Wymiana.com

EcoEnergy Drive

PWSZ

T&E Herbalists Ltd

Bubbles&Candies

Zaslony-firany.pl